Financial Dashboard

Overview

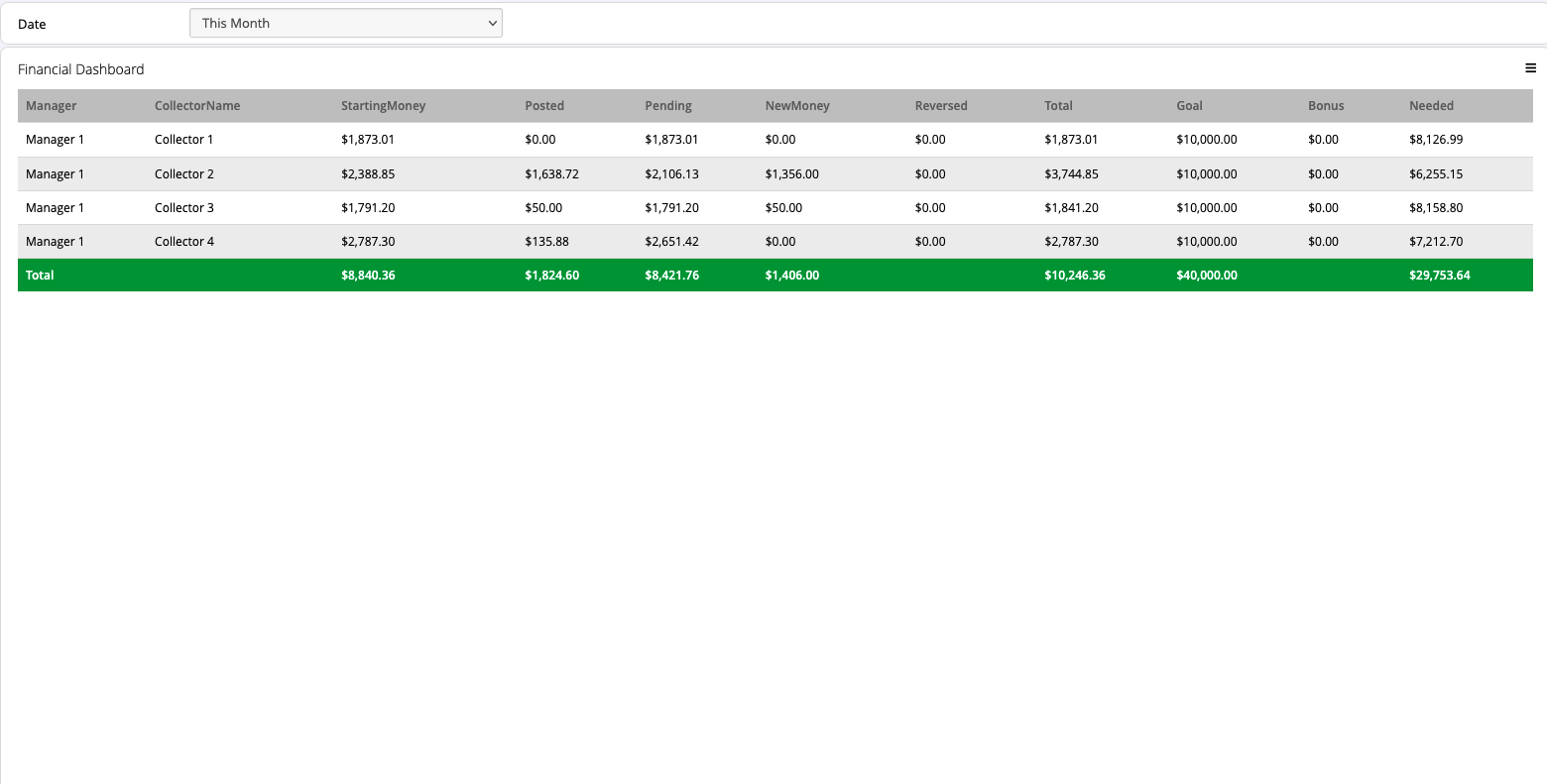

The Financial Dashboard is your personal scoreboard for tracking revenue performance and bonus earnings. This comprehensive report shows your monthly collection activity, breaking down payments by status and timing. With real-time visibility into your posted, pending, and reversed payments, you can track your progress toward monthly goals and calculate your expected bonus. This is the go-to report for understanding your financial contribution to the organization and maximizing your earnings potential.

Key Benefits

- Track Monthly Revenue: See all your collections in one place

- Monitor Goal Progress: Know exactly how much more you need to collect

- Calculate Bonuses: Automatic bonus calculations based on performance

- Identify Reversals: Quickly spot and address declined payments

- Distinguish Money Types: Separate new money from starting money

Understanding Your Data

| Column | What It Means | How to Use It |

|---|---|---|

| Manager | Your supervisor's name | Know your reporting structure |

| CollectorName | Your name | Confirm you're viewing your data |

| StartingMoney | Payments set up before this month but collected now | Understand carryover revenue |

| Posted | Successfully processed payments | Your confirmed revenue |

| Pending | Scheduled payments not yet processed | Expected future revenue |

| NewMoney | Net new revenue (new payments minus reversals) | Your fresh collections this month |

| Reversed | Failed or declined payments | Issues to address |

| Total | Posted + Pending payments | Your complete revenue picture |

| Goal | Your monthly collection target | What you're aiming for |

| Bonus | 25% of collections above goal | Your extra earnings |

| Needed | Amount required to reach goal | Focus for remaining days |

Using This Report

Report Filters

The Financial Dashboard includes the following filter options:

Date Range Filter

- View Current Month: Default view shows current month performance

- Review Past Months: Analyze previous months for trends

- Custom Periods: Select specific date ranges for special analysis

- Year-to-Date View: See cumulative performance for the year

Collector View Filter

Available upon request- Personal View: Collectors can be restricted to see only their own numbers

- Privacy Mode: Ensures collectors focus on their individual performance

- Manager Override: Managers can still see all collector data

- Configuration: Contact your administrator to enable this privacy setting

Daily Performance Tracking

Morning Check

- Review your Total vs Goal

- Calculate daily target: Needed ÷ remaining work days

- Check for overnight reversals

Mid-Day Review

- Monitor Posted payments (confirmed revenue)

- Track Pending payments (future revenue)

- Address any new reversals immediately

End of Day

- Verify NewMoney additions

- Update pending payment schedules

- Plan tomorrow's collection strategy

Understanding Money Types

- Starting Money: Carryover from previous months' efforts now paying off

- New Money: Fresh revenue generated this month (your current productivity)

- Posted vs Pending: Posted is in the bank, Pending is scheduled but not guaranteed

Bonus Calculation

Your bonus is calculated automatically:

- Collect below goal = $0 bonus

- Collect above goal = 25% of excess as bonus

Example: Goal is $10,000, you collect $12,000

- Excess = $2,000

- Bonus = $2,000 × 25% = $500

Taking Action

Based on your dashboard data, implement these strategies:

When Below Goal

- Calculate daily requirements (Needed ÷ days left)

- Focus on high-balance accounts

- Convert more promises to payments

- Minimize payment delays

When Above Goal

- Maintain momentum to maximize bonus

- Help teammates reach their goals

- Document successful strategies

- Plan for next month's target

Managing Reversals

- Contact customers immediately when payments fail

- Update payment information quickly

- Reschedule failed payments same day

- Track reversal patterns to prevent future failures

Best Practices

- Set Daily Targets: Break monthly goal into daily achievements

- Monitor Throughout Day: Check progress multiple times

- Address Reversals Fast: Same-day follow-up on failures

- Balance New vs Old: Focus on new money while maintaining starting money

- Plan Ahead: Schedule payments throughout the month, not just month-end

Performance Strategies

Early Month (Days 1-10)

- Build momentum with quick wins

- Set up payment schedules

- Contact all high-value accounts

- Establish strong pipeline

Mid Month (Days 11-20)

- Maintain steady collection pace

- Follow up on pending payments

- Address any account issues

- Stay on track for goal

Late Month (Days 21-31)

- Push for final collections

- Convert all possible accounts

- Minimize new reversals

- Maximize bonus opportunity

Tips for Success

- Consistency Wins: Steady daily progress beats end-of-month scrambles

- Quality Matters: Good payment setups reduce reversals

- Time Management: Allocate time based on account value

- Learn from Reversals: Each failure is a learning opportunity

- Celebrate Wins: Acknowledge when you exceed goals

Related Reports

- Desk Management - Manage your account workload

- Payment Dashboard - Detailed payment tracking

- Collector Payment Performance Comparison - Compare with peers

- Portfolio Liquidation by Collector - Portfolio-specific performance