Payment Processors

Payment Processors configuration allows administrators to set up and manage the payment gateways used by DebtRecoup for processing card and ACH payments.

Accessing Payment Processors

- Click the settings icon in the top navigation bar

- Select Payments from the left sidebar

- Click on Processors

Supported Processors

DebtRecoup supports the following payment processors:

| Processor | Type | Description |

|---|---|---|

| USAePay | Card/ACH | Full-service payment gateway |

| Authorize.Net | Card | Popular payment gateway |

| Manual | N/A | Built-in processor for tracking manual/offline payments |

Adding a Processor

USAePay Configuration

- Click Add

- Select USAePay as the processor type

- Enter the required credentials:

| Field | Description |

|---|---|

| API Key | Your USAePay API key |

| API Pin | Your USAePay API pin |

- Click Save

Authorize.Net Configuration

- Click Add

- Select Authorize.Net as the processor type

- Enter the required credentials:

| Field | Description |

|---|---|

| API Login ID | Your Authorize.Net API login ID |

| Transaction Key | Your Authorize.Net transaction key |

- Click Save

Setting the Default Processor

One processor must be designated as the default for payment processing.

- Find the processor you want to make default

- Click Set as Default

- The processor displays a "Default" badge

Editing a Processor

- Click the Edit button (pencil icon) on the processor

- Update the credentials as needed

- Click Save

Credential Security

Processor credentials are masked in the interface. Only users with Supervisor or higher roles can view the full credentials.

Deleting a Processor

- Click the Delete button (trash icon) on the processor

- Confirm the deletion

Cannot Delete Default

You cannot delete the default processor. Set a different processor as default first.

Manual Processor

The Manual processor is a built-in option for tracking payments received outside of electronic processing, such as:

- Cash payments

- Money orders

- Checks deposited directly

No configuration is required for the Manual processor.

Troubleshooting

Authentication Failed

- Verify your API credentials are correct

- Check that your processor account is active

- Ensure you're using the correct environment (production vs sandbox)

Transactions Declining

- Verify the payment method details

- Check processor account status

- Review decline codes from the processor

Related Documentation

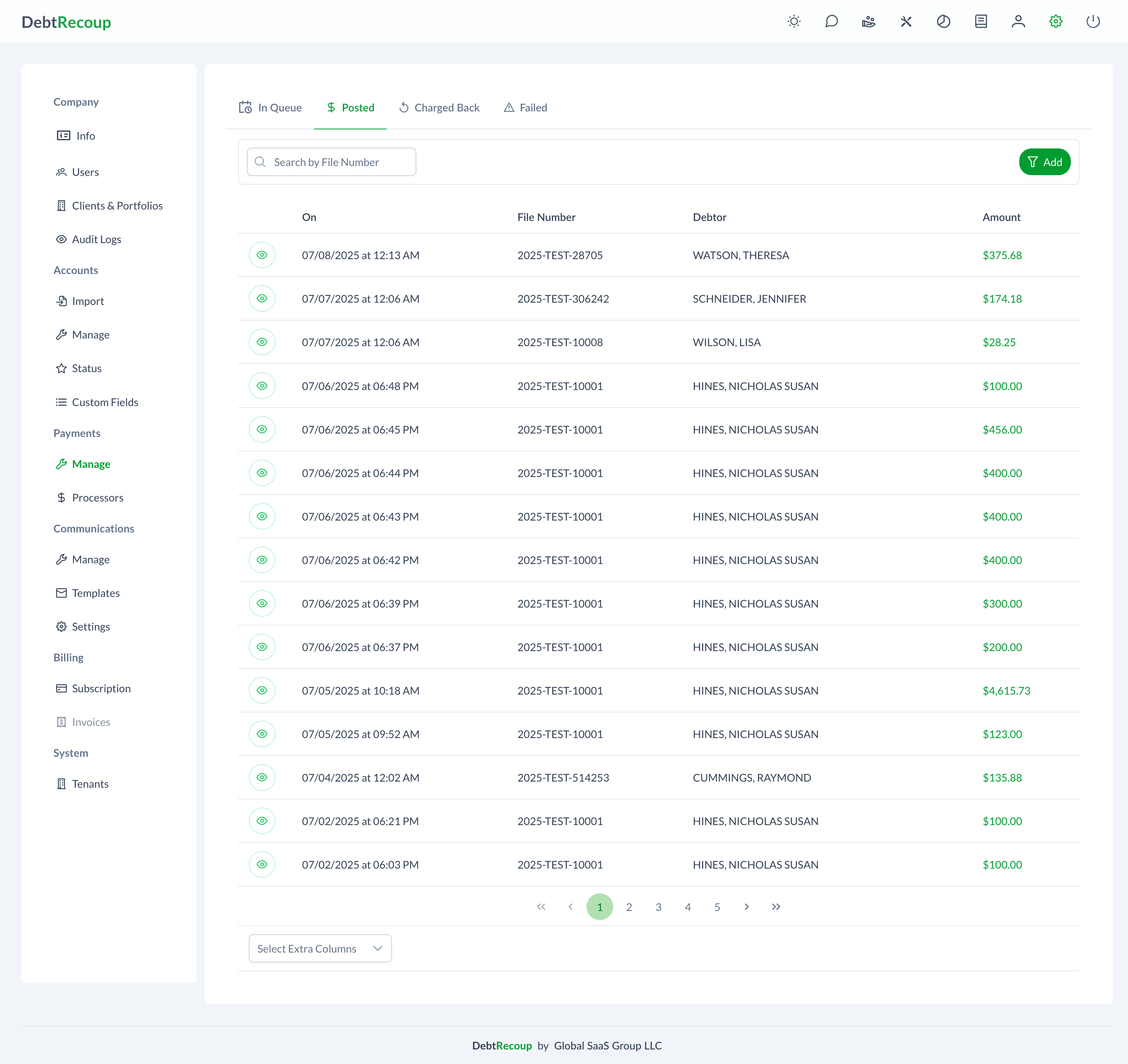

- Manage Payments - Payment transaction management

- Payment Processing - Collector payment entry

- Payment Queue - Queued payments