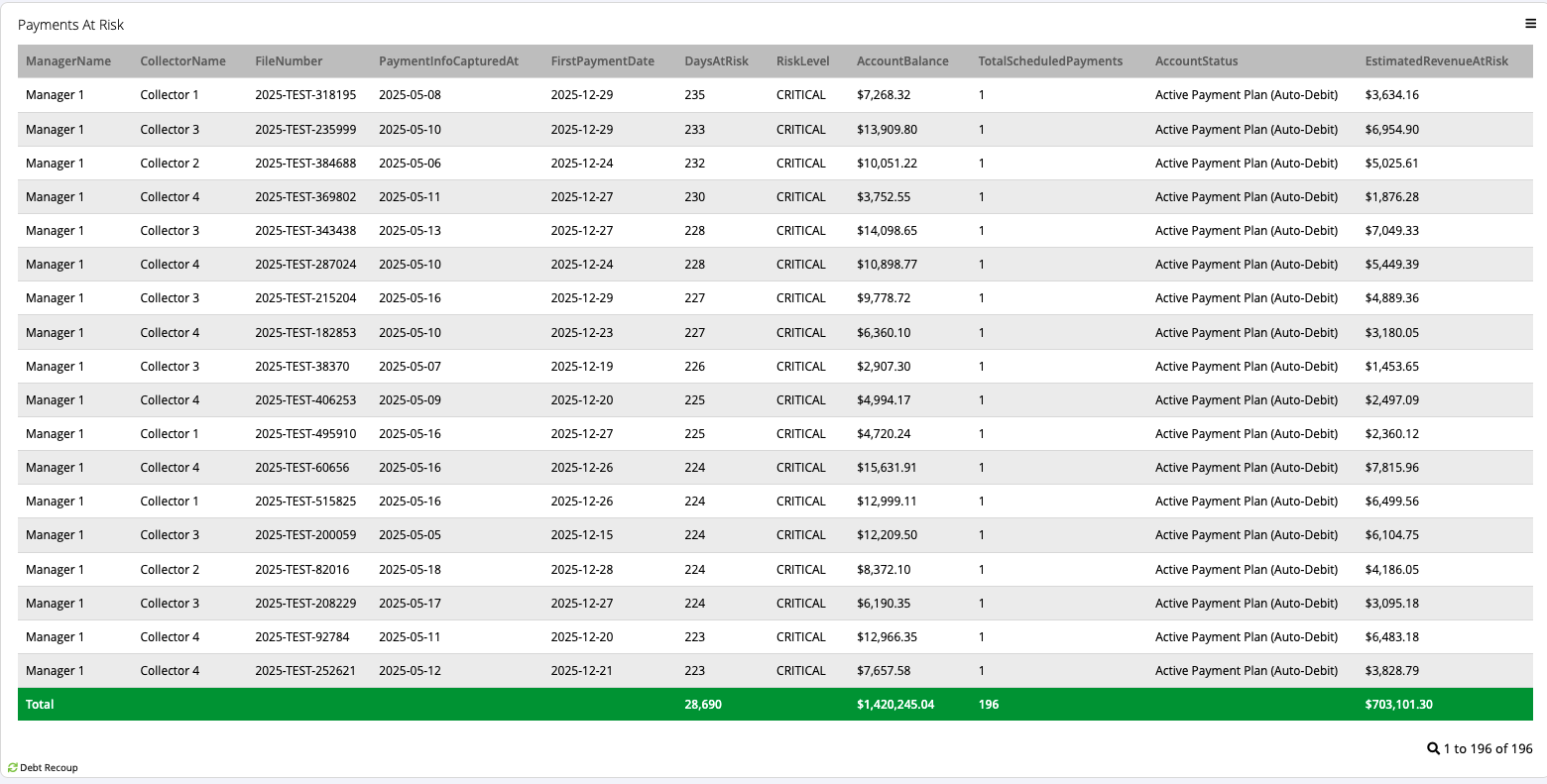

Payments at Risk

Overview

The Payments at Risk report is a critical early warning system that identifies accounts where payment failure is likely due to extended time gaps between payment setup and processing. This report flags accounts where collectors captured payment information but scheduled the first payment more than 14 days in the future. During these extended delays, cards can expire, bank accounts can close, and customers may change their minds. By identifying these at-risk payments early, managers can take proactive steps to protect revenue.

Key Benefits

- Prevent Payment Failures: Identify payments likely to fail before they process

- Protect Revenue: Take action to save at-risk collections

- Improve Timing: Coach collectors on optimal payment scheduling

- Risk Prioritization: Focus on highest-risk, highest-value accounts first

- Team Performance: Identify collectors who consistently create risky delays

Understanding Your Data

| Column | What It Means | How to Use It |

|---|---|---|

| ManagerName | Supervising manager | Accountability and oversight |

| CollectorName | Collector who set up payment | Identify training needs |

| FileNumber | Account reference | Look up specific accounts |

| PaymentInfoCapturedAt | When payment details were entered | Start of risk window |

| FirstPaymentDate | When first payment will process | End of risk window |

| DaysAtRisk | Gap between setup and payment | Risk severity indicator |

| RiskLevel | MODERATE, HIGH, or CRITICAL | Prioritize intervention |

| AccountBalance | Total amount owed | Financial impact |

| TotalScheduledPayments | Number of payments planned | Payment plan complexity |

| AccountStatus | Current account status | Context for risk |

| EstimatedRevenueAtRisk | Potential loss calculation | Financial exposure |

Risk Level Categories

CRITICAL Risk (>60 days)

- Risk Factor: 50% chance of payment failure

- Common Issues: Card expiration, account closure, complete disengagement

- Action Required: Immediate intervention within 24 hours

HIGH Risk (30-60 days)

- Risk Factor: 25% chance of payment failure

- Common Issues: Changed financial situation, second thoughts

- Action Required: Contact within 48 hours

MODERATE Risk (14-30 days)

- Risk Factor: 10% chance of payment failure

- Common Issues: Minor card issues, address changes

- Action Required: Review and monitor weekly

Using This Report

Daily Management Process

Morning Priority Review

- Sort by RiskLevel and DaysAtRisk (highest first)

- Identify any new CRITICAL risks

- Assign immediate follow-up tasks

Risk Assessment

- Review EstimatedRevenueAtRisk totals

- Calculate team's total exposure

- Prioritize by financial impact

Collector Coaching

- Identify collectors with multiple at-risk accounts

- Review their payment scheduling practices

- Provide immediate feedback

Understanding the Risk

The report only evaluates first payments that are still pending. If a first payment has already posted successfully, the account is excluded because the risk has passed. This focuses your attention on genuinely at-risk situations.

Example Scenarios:

- ✅ GOOD: Payment info captured Jan 1, first payment Jan 10 (9 days)

- ⚠️ AT RISK: Payment info captured Jan 1, first payment Feb 1 (31 days)

- ✅ SAFE: First payment already posted (excluded from report)

Taking Action

Based on risk levels, implement these strategies:

For CRITICAL Risk Accounts (>60 days)

Immediate Contact

- Call customer same day

- Verify payment method is still valid

- Confirm customer's commitment

Adjust Payment Schedule

- Move first payment to within 7 days

- Consider immediate partial payment

- Get fresh payment authorization

Document Everything

- Record why delay was created

- Note customer's current situation

- Update account status

For HIGH Risk Accounts (30-60 days)

48-Hour Follow-up

- Proactive customer contact

- Confirm payment intent

- Address any concerns

Payment Validation

- Verify card expiration dates

- Confirm account numbers

- Update any changed information

Consider Alternatives

- Offer to move payment date closer

- Suggest smaller initial payment

- Provide payment reminder service

For MODERATE Risk Accounts (14-30 days)

Weekly Monitoring

- Track progression toward payment date

- Note any account activity changes

- Prepare for payment processing

Preventive Measures

- Send payment reminders

- Confirm contact information

- Document continued engagement

Best Practices

- Optimal Timing: Schedule first payments within 7-10 days

- Customer Psychology: Shorter gaps maintain commitment momentum

- Card Expiration: Always check expiration dates before scheduling

- Clear Expectations: Ensure customers understand payment timing

- Regular Reviews: Check this report daily for new risks

Revenue Protection Strategies

Calculating Financial Impact

The report estimates revenue at risk based on industry-standard failure rates:

- CRITICAL (>60 days): 50% of balance at risk

- HIGH (30-60 days): 25% of balance at risk

- MODERATE (14-30 days): 10% of balance at risk

Team Performance Metrics

Monitor these patterns:

- Average gap days by collector

- Risk level distribution by team

- Success rate after intervention

- Revenue saved through proactive action

Tips for Success

- Train on Timing: Educate collectors on optimal payment scheduling

- Use Psychology: Leverage commitment while it's fresh

- Technology Helps: Use automated reminders for longer gaps

- Document Reasons: Track why long delays are sometimes necessary

- Celebrate Saves: Recognize successful risk interventions

Related Reports

- Payment Dashboard - Monitor payment success rates

- Financial Dashboard - Track revenue impact

- Accounts By Date - Review collector daily activity

- Collector Payment Performance Comparison - Analyze payment success patterns