Deceased Debtor Handling

Overview

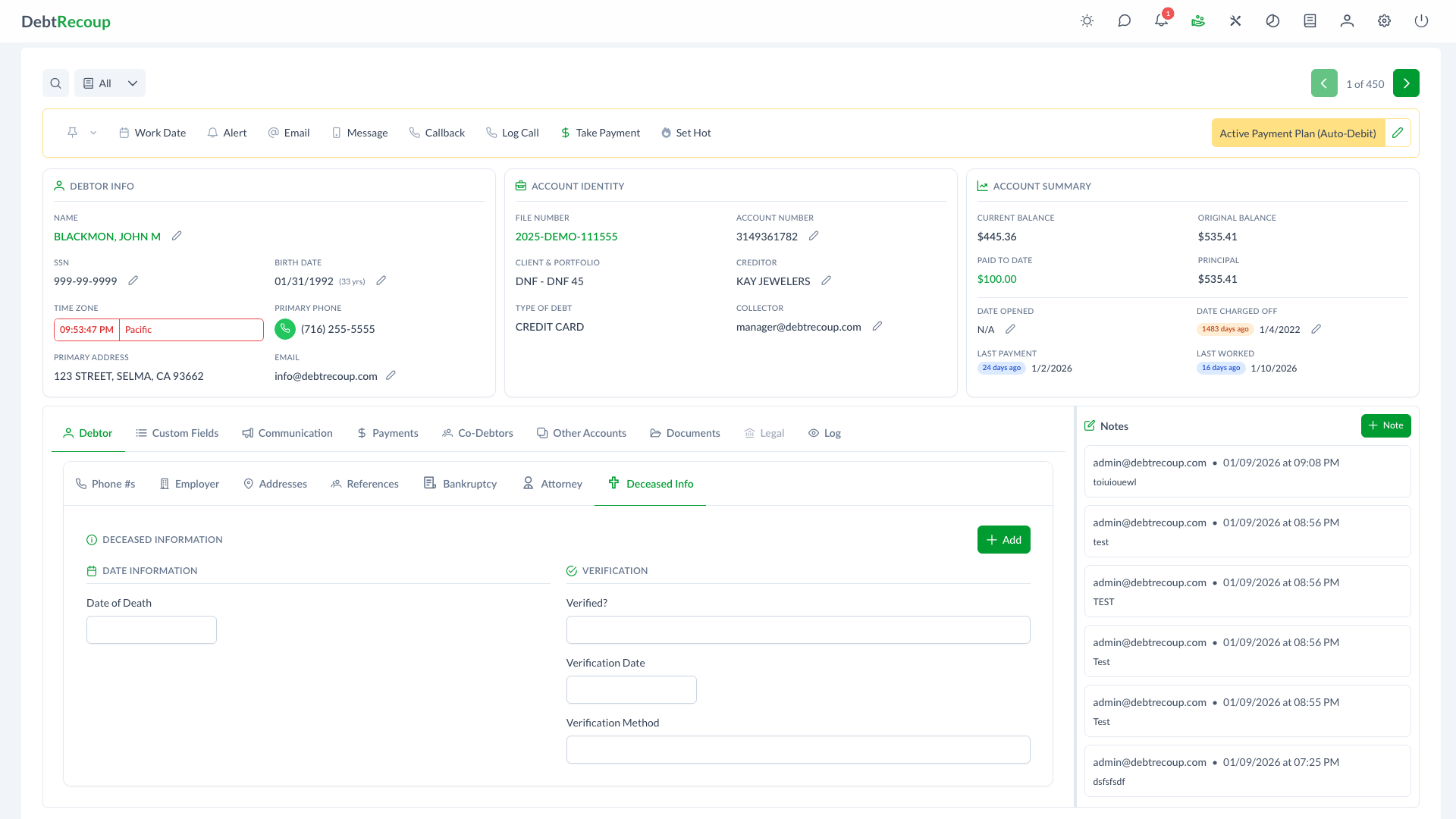

The Deceased Debtor Handling feature in DebtRecoup allows you to track and manage accounts where the debtor has passed away. This feature ensures proper documentation of death information, verification status, and compliance with regulations governing the collection of debts from deceased individuals' estates.

Key Benefits

- Centralized Tracking: Maintain all deceased debtor information in one organized location

- Verification Management: Track whether death information has been verified and document the verification method

- Compliance Support: Proper documentation helps ensure adherence to FDCPA and state regulations

- Clear Status Display: Read-only view prevents accidental modifications while allowing authorized updates

- Audit Trail: Maintains records of when information was added and verified

Understanding Your Data

Date Information

The Date Information section captures the essential timeline data:

| Field | Description |

|---|---|

| Date of Death | The date when the debtor passed away. This is the primary piece of information that triggers deceased account handling procedures. |

Verification Section

The Verification section tracks confirmation of the death information:

| Field | Description |

|---|---|

| Verified | Indicates whether the death information has been confirmed (Yes/No). When set to Yes, enables additional verification fields. |

| Verification Date | The date when the death was verified. Only available when Verified is set to Yes. |

| Verification Method | How the death was confirmed (e.g., death certificate, obituary, family member confirmation, credit bureau notification). Only available when Verified is set to Yes. |

Using This Feature

Recording Deceased Status

When you learn that a debtor has passed away:

- Navigate to the account in DebtRecoup

- Access the Deceased Information section

- Click the Add button to open the dialog

- Enter the Date of Death

- Set Verified to No if unconfirmed, or Yes if you have documentation

- Click Save to record the information

Verifying Death Information

When you receive confirmation of the death:

- Navigate to the account's Deceased Information section

- Click the Edit button to open the dialog

- Change Verified to Yes

- Enter the Verification Date

- Enter the Verification Method (e.g., "Death certificate received", "Obituary verified", "Credit bureau notification")

- Click Save to update the record

Editing Deceased Information

To modify existing deceased information:

- Click the Edit button (appears when deceased information already exists)

- Update the relevant fields in the dialog

- Click Save to apply changes

Removing Deceased Status

If deceased information was entered in error:

- Click the Edit button to open the dialog

- Click the Remove button at the bottom left of the dialog

- The deceased status will be removed from the account

Compliance Considerations

Proper handling of deceased debtor accounts is critical for regulatory compliance:

FDCPA Requirements

- Do not contact the deceased debtor directly (obviously)

- Only contact authorized parties such as the executor, administrator, or surviving spouse regarding the debt

- Do not misrepresent the obligation to pay to unauthorized third parties

- Document all communications regarding the deceased status

State-Specific Regulations

- Many states have specific requirements for collecting from estates

- Statute of limitations may be affected by the debtor's death

- Some states require filing claims within specific timeframes after death

- Consult your compliance team for jurisdiction-specific requirements

Documentation Best Practices

- Always document the source of death notification

- Keep copies of verification documents (death certificates, obituaries)

- Record the date you learned of the death

- Note any estate or probate case information

Best Practices

When Death is First Reported

- Record the information immediately with the date of death

- Set verification status to No until confirmed

- Add a note documenting who provided the information

- Place a hold on automated collection activities

- Research estate and executor information

Verification Process

- Request a death certificate when possible

- Search obituary records for confirmation

- Check credit bureau data for death indicators

- Document the verification method clearly

- Update the verification date when confirmed

Working Deceased Accounts

- Identify the executor or administrator of the estate

- File claims with the probate court if required

- Follow up on estate timelines

- Document all estate-related communications

- Close the account appropriately when resolution is reached

Team Coordination

- Ensure all team members know how to identify deceased accounts

- Establish procedures for routing deceased account inquiries

- Train staff on appropriate communication with estate representatives

- Review deceased accounts regularly for follow-up actions

Related Topics

- Notes and Alerts - Documenting deceased status discoveries

- Skips - Locating estate representatives

- Account Status Management - Updating account status for deceased debtors