Processing Payments

This quick-reference guide covers the essential steps for recording payments in DebtRecoup.

Detailed Reference

For complete information about payment types, fields, statuses, and advanced features, see Payment Processing.

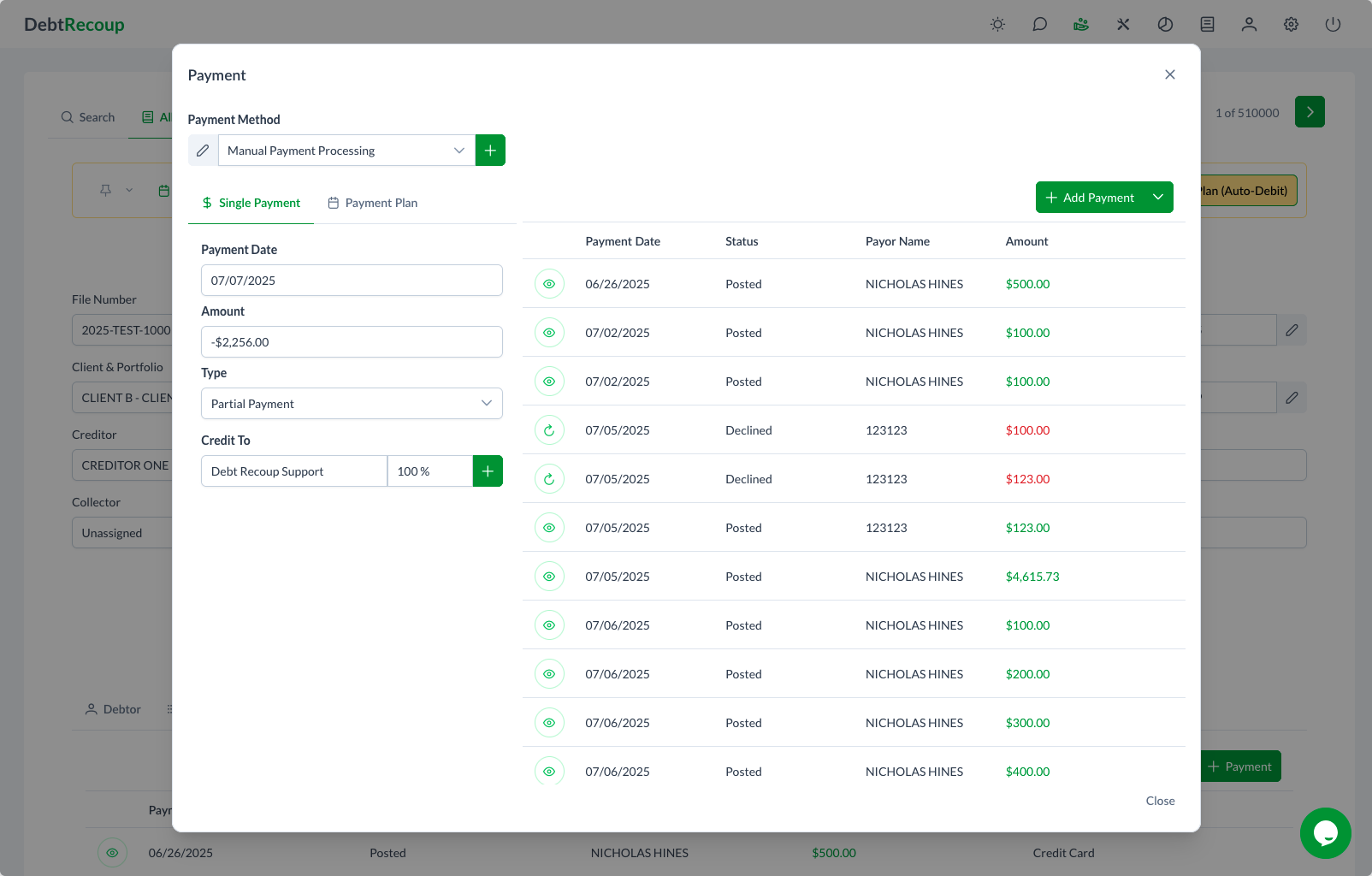

Quick Workflow: Single Payment

- Click Take Payment button in the action toolbar

- Select the Single Payment tab (default)

- Choose payment method from dropdown

- Enter the payment amount

- Select payment type (Partial Payment, Balance in Full, or Settlement)

- Review credit distribution if needed

- Click Add Payment (or Process Payment if payment date is today)

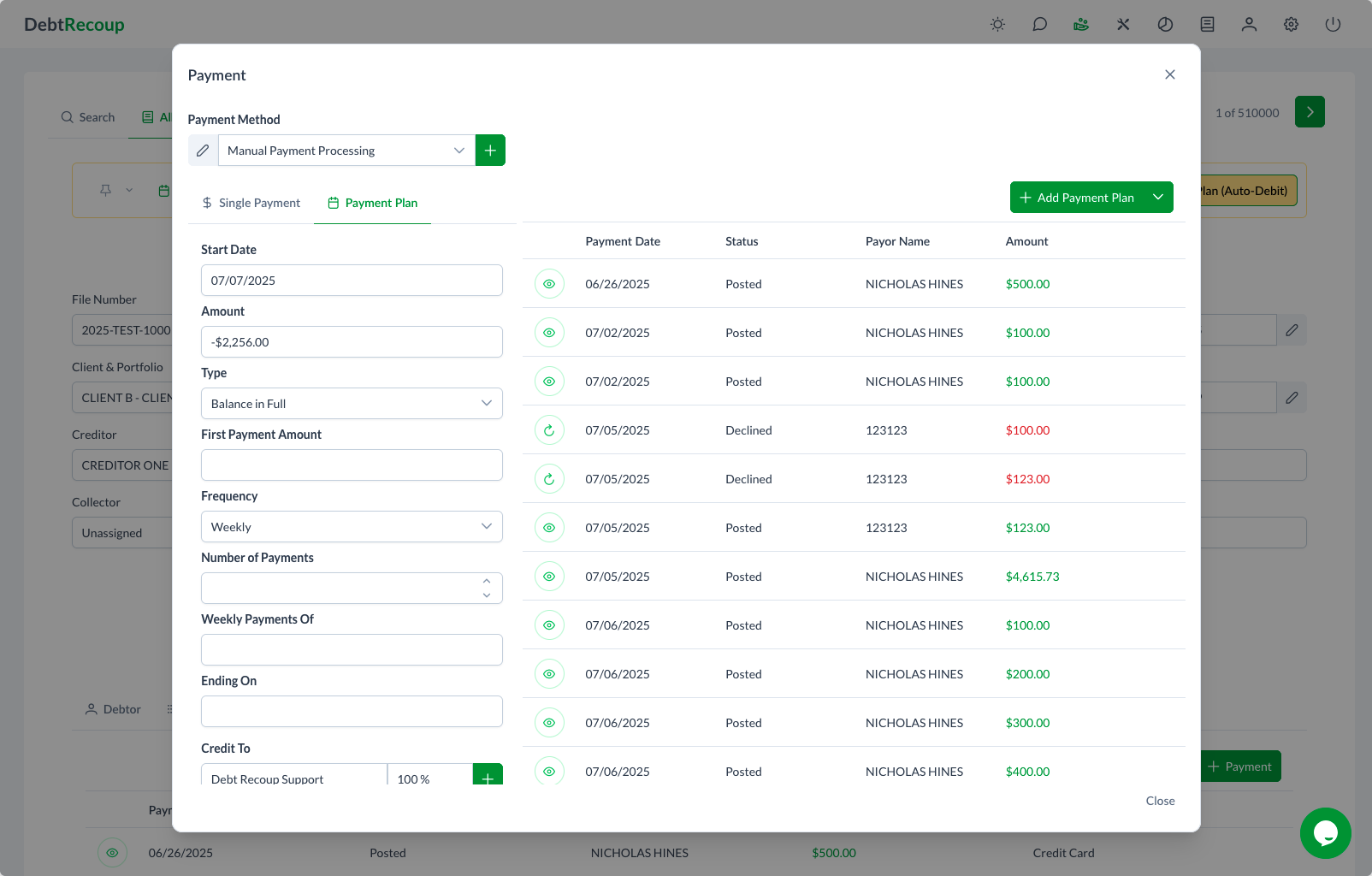

Quick Workflow: Payment Plan

Payment plans use a 3-step wizard:

Step 1: Details

- Click Take Payment button in the action toolbar

- Click the Payment Plan tab

- Set the Down Payment Date

- Enter Down Payment Amount (if applicable)

- Click Next

Step 2: Schedule

- Choose frequency (Weekly, Every 2 Weeks, or Monthly)

- Either:

- Enter Number of Installments to calculate the installment amount, OR

- Enter Installment Amount to calculate the number of installments

- Review the calculated end date

- Click Next

Step 3: Review

- Review the payment plan summary

- Click Add Payment Plan (or Process Payment Plan if down payment is today)

Related Topics

- Payment Processing - Complete payment reference

- Payments Tab - View payment history

- Payment Dashboard - Payment analytics