Manage Payments

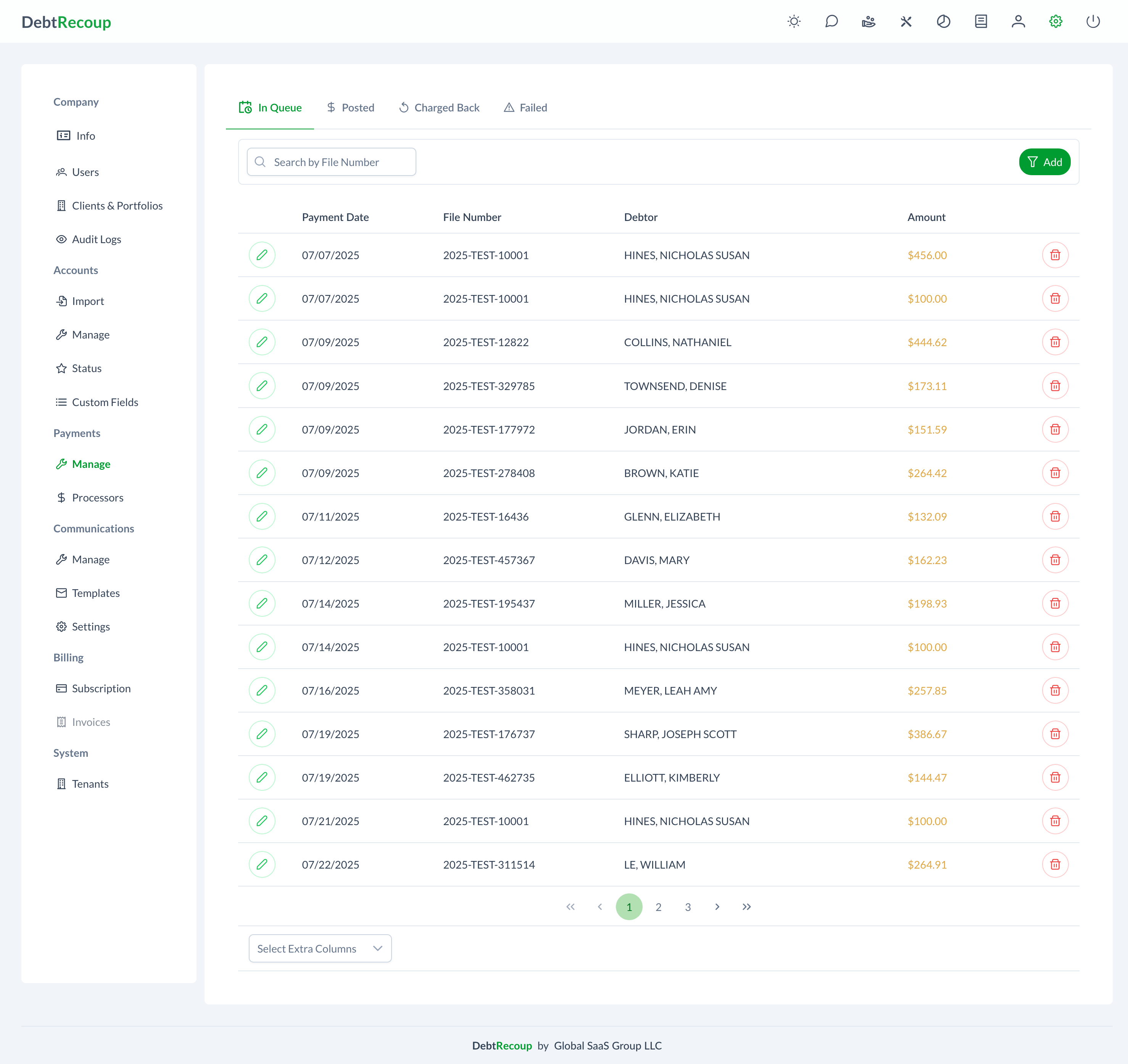

The Manage Payments interface provides administrators with tools to view and track all payment transactions across the system. This central dashboard allows you to monitor payment statuses and handle exceptions.

Accessing Payment Management

- Click the settings icon in the top navigation bar

- Select Payments from the left sidebar

- Click on Manage

Payment Status Tabs

The interface organizes payments by status, with each tab providing a focused view of payments in that stage of processing.

In Queue

Payments waiting to be processed, including those pending authorization or scheduled for future dates. This tab allows you to review, edit, or delete payments before they are finalized.

For detailed information about managing queued payments, see Payment Queue.

Posted

Successfully processed payments where funds have been received and applied to accounts. This view provides a transaction history for reconciliation purposes.

For detailed information about viewing posted payments, see Posted Payments.

Charged Back

Payments that were reversed after posting, typically due to insufficient funds, disputes, or fraud claims. This view helps you monitor the impact of reversals.

For detailed information about tracking chargebacks, see Chargebacks.

Failed

Payments that encountered processing errors, including authorization declines or invalid payment methods. This view enables you to retry failed payments or take corrective action.

For detailed information about handling failed payments, see Failed Payments.

Payment Operations

Viewing Payment Details

Click the view button (eye icon) on any payment to see full transaction details including:

- Payment amount and date

- Payment method information

- Account attribution breakdown

- Processing status

Editing Queued Payments

For payments in the queue:

- Click the edit button (pencil icon)

- Modify payment details as needed

- Click Save

Deleting Queued Payments

For payments in the queue:

- Click the delete button (trash icon)

- Confirm the deletion

Voiding Payments

To void a payment:

- Open the payment dialog

- Click Void

- Enter a reason for the void

- Confirm the action

Marking as Charged Back

To record a chargeback:

- Open the payment dialog for a posted payment

- Click Charge Back

- Confirm the action

Retrying Failed Payments

To retry a failed payment:

- Click the edit button on the failed payment

- Review and correct payment details if needed

- Click Retry to reprocess

Best Practices

Daily Procedures

Morning Review

- Check the queue for pending payments

- Review any failed payments

- Process payments as needed

Throughout Day

- Monitor payment statuses

- Handle failures promptly

- Update notes as needed

Quality Control

- Verify payment amounts before processing

- Double-check payment method details

- Review account balances after posting

Troubleshooting

Payment Won't Post

- Check account status

- Verify payment method is valid

- Review any error messages

Missing Payments

- Search all status tabs

- Check date filters

- Verify the payment was entered

Failed Payment

- Review the error code and message

- Verify payment method details

- Contact the debtor for updated information if needed

Related Topics

- Payment Queue - Manage payments waiting to be processed

- Posted Payments - View successfully processed payments

- Failed Payments - Handle payment processing errors

- Chargebacks - Track reversed payments

- Payment Processors - Configure payment methods

- Payment Processing - Collector payment entry