Payment Processing

Overview

DebtRecoup provides payment processing capabilities including single payments and payment plans. The system tracks all payment activity and maintains transaction histories.

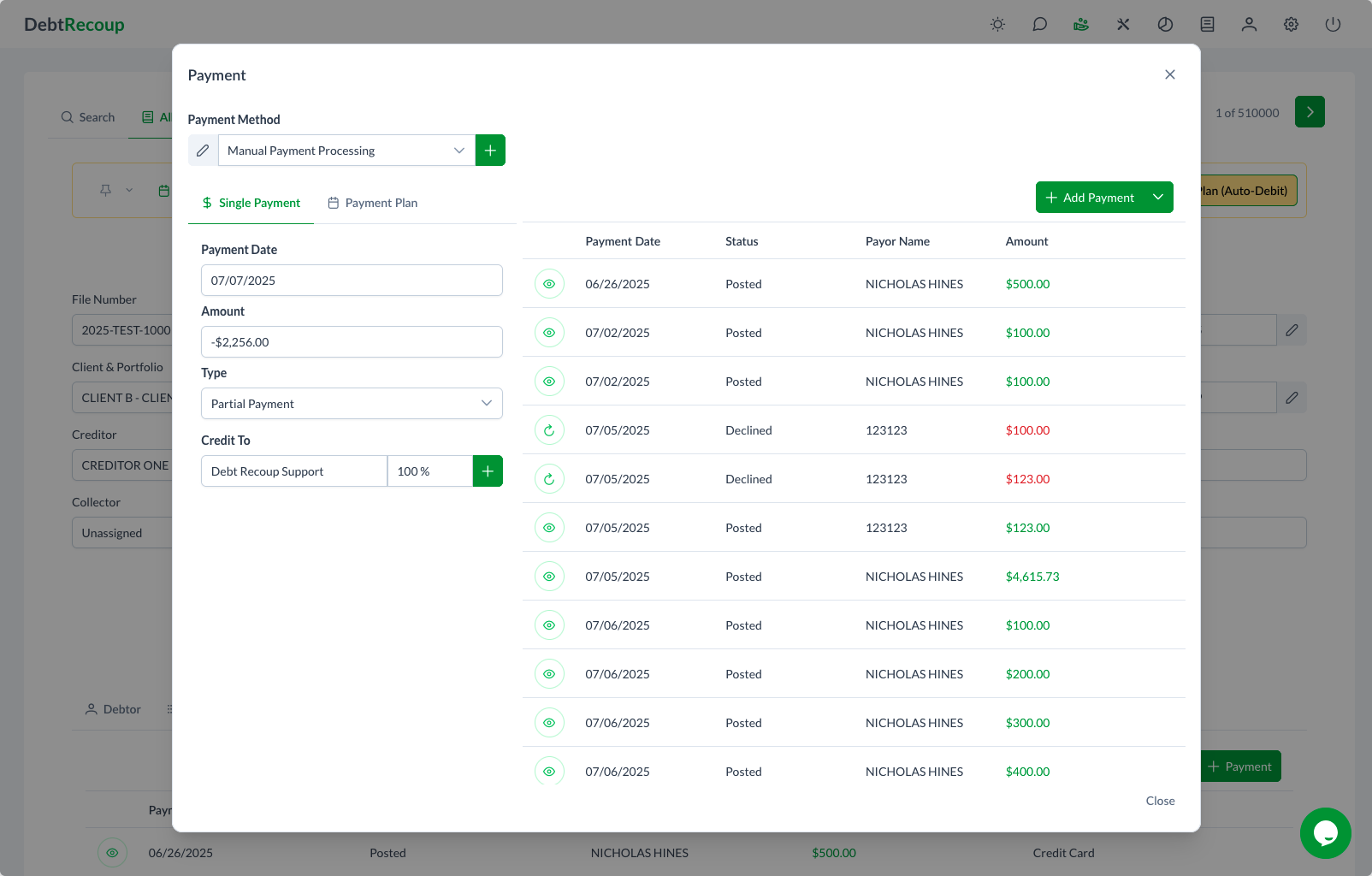

Payment Modal

Accessing Payments

To process a payment:

- Open the account

- Click Take Payment button

- Payment modal opens

- Select payment type (Single Payment or Payment Plan)

- Enter payment details

- Submit the payment

Payment Tabs

The payment modal contains two main tabs:

- Single Payment - One-time payments

- Payment Plan - Recurring payment schedules

Single Payments

Payment Fields

| Field | Description |

|---|---|

| Payment Method | How the payment is being made (Credit Card, ACH, Check, etc.) |

| Payment Date | Date of the payment (defaults to today) |

| Amount | Payment amount |

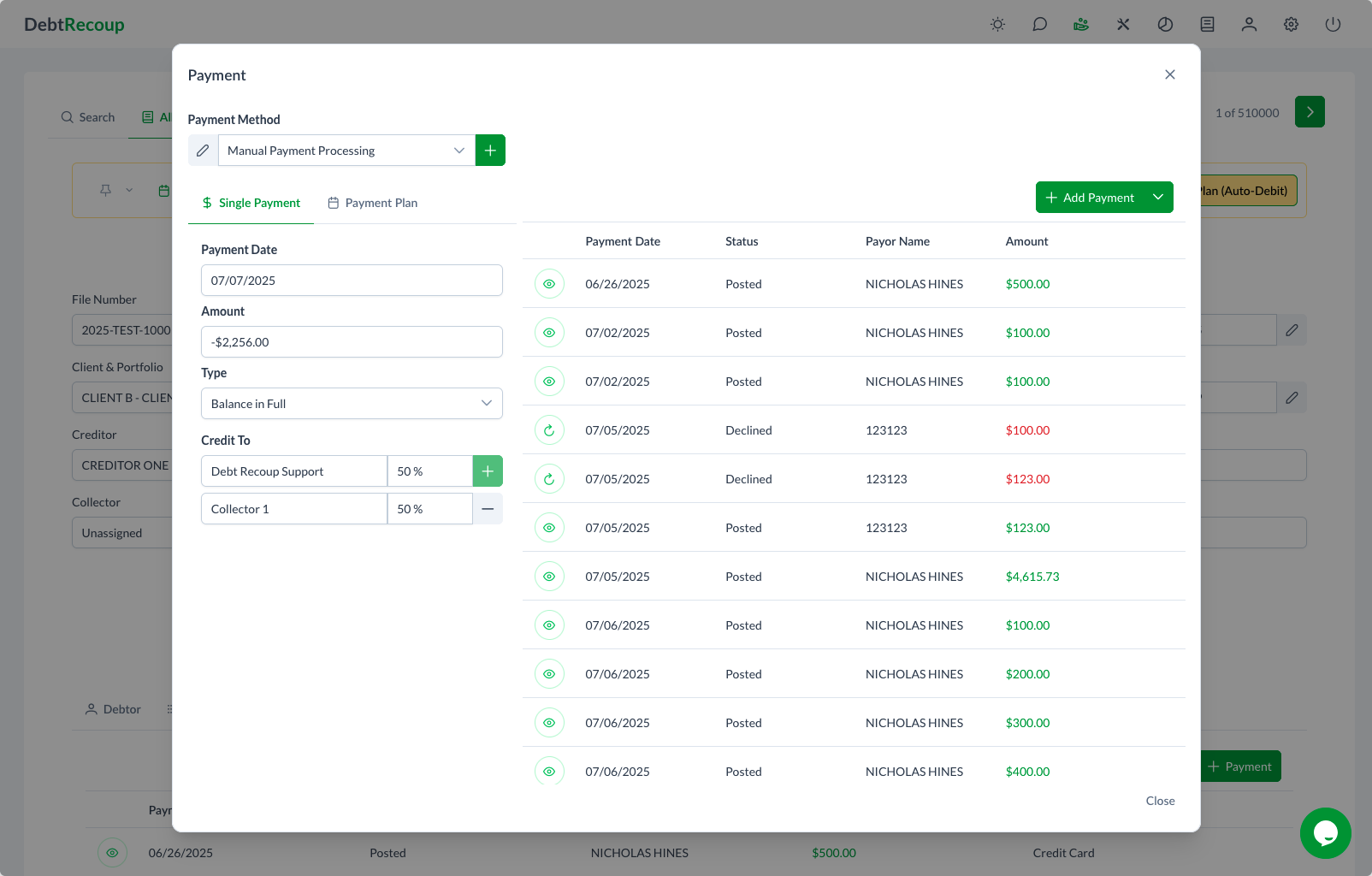

| Type | Payment type (Partial, Balance in Full, Settlement) |

Credit Attribution

Payments can be credited to one or more collectors:

- Add additional collector rows to split credit

- Assign percentages to each collector

- Percentages must total 100%

Payment History

The payment modal shows previous payments on the right side, including:

- Payment dates and amounts

- Payment status

- Payor information

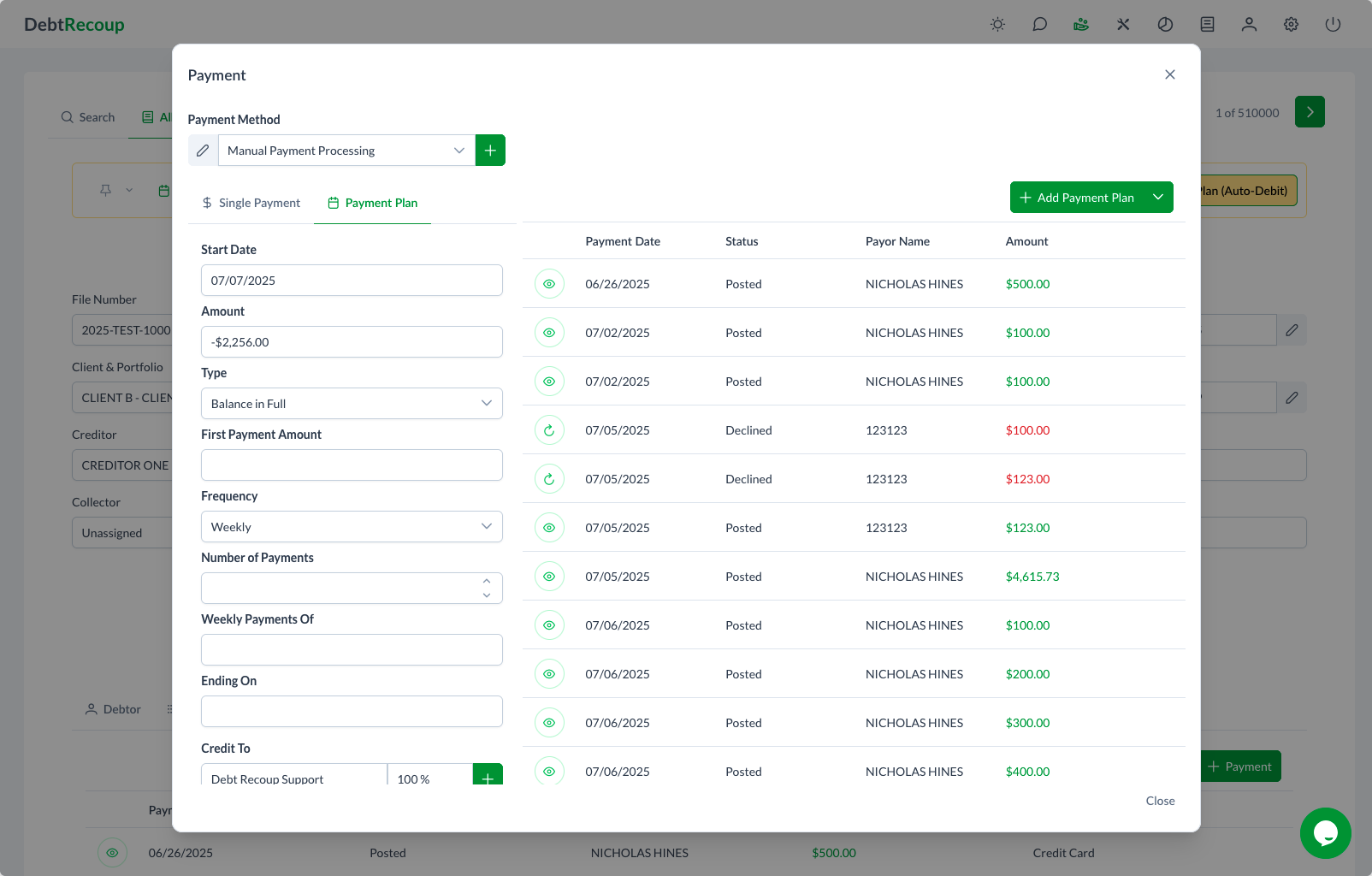

Payment Plans

Creating Payment Plans

| Field | Description |

|---|---|

| Down Payment | Initial payment amount (can differ from regular installments) |

| Installments | Regular payment amount |

| Frequency | How often payments occur (Weekly, Bi-weekly, Monthly) |

| Number of Payments | Total number of installment payments |

| Start Date | When the first installment is due |

| Ending On | Calculated final payment date |

Payment Status

Payments can have the following statuses:

| Status | Description |

|---|---|

| Posted | Successfully processed |

| Queued | Scheduled for processing |

| Failed | Payment was declined |

| Chargebacks | Payment was reversed |

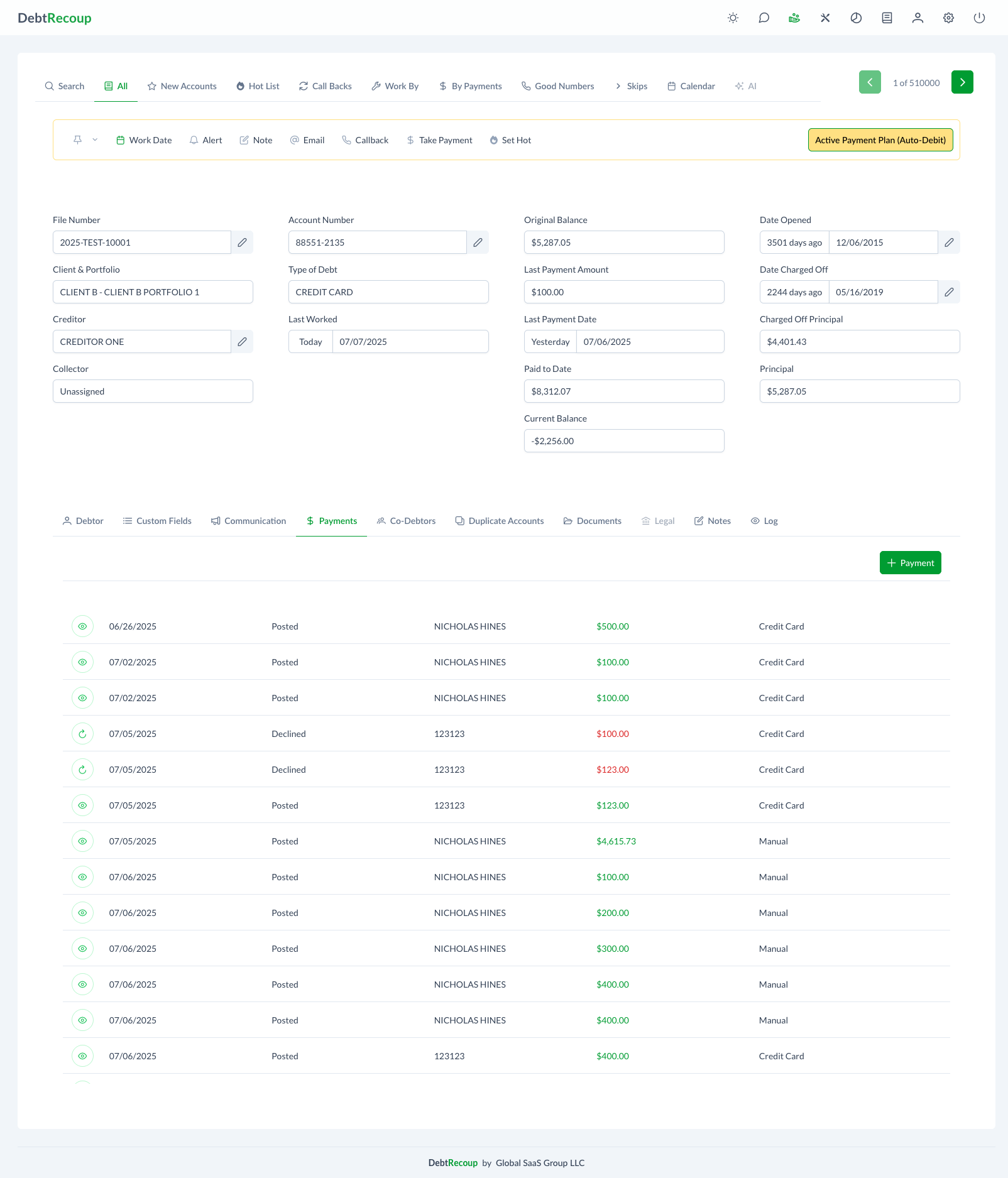

Payment Tab

The Payments tab on an account shows:

- All payment attempts

- Payment status for each transaction

- Payment methods used

- Transaction details

Best Practices

Payment Entry

- Double-check amounts before submitting

- Verify the payment method is correct

- Select the appropriate payment type

- Process payments promptly

Payment Plans

- Set realistic payment amounts the debtor can afford

- Consider processing time when setting start dates

- Monitor plan compliance

Credit Attribution

- Apply credit fairly based on who secured the payment

- Document credit split decisions when needed

Related Topics

- Processing Payments Workflow - Step-by-step guide

- Payment Tab - Payment history

- By Payments - Payment activity view