Payment Portal

The Payment Portal is a customer-facing interface that allows debtors to view their account information and make payments online. It can be embedded on your company website.

Overview

The Payment Portal provides debtors with:

- Account balance and details

- Single payment processing

- Payment plan setup and management

- Secure payment method entry

- Payment confirmation

Accessing Payment Portal Settings

- Click the Administrator button (gear icon) in the top navigation

- Select Payments from the sidebar

- Click Portal

Configuration Settings

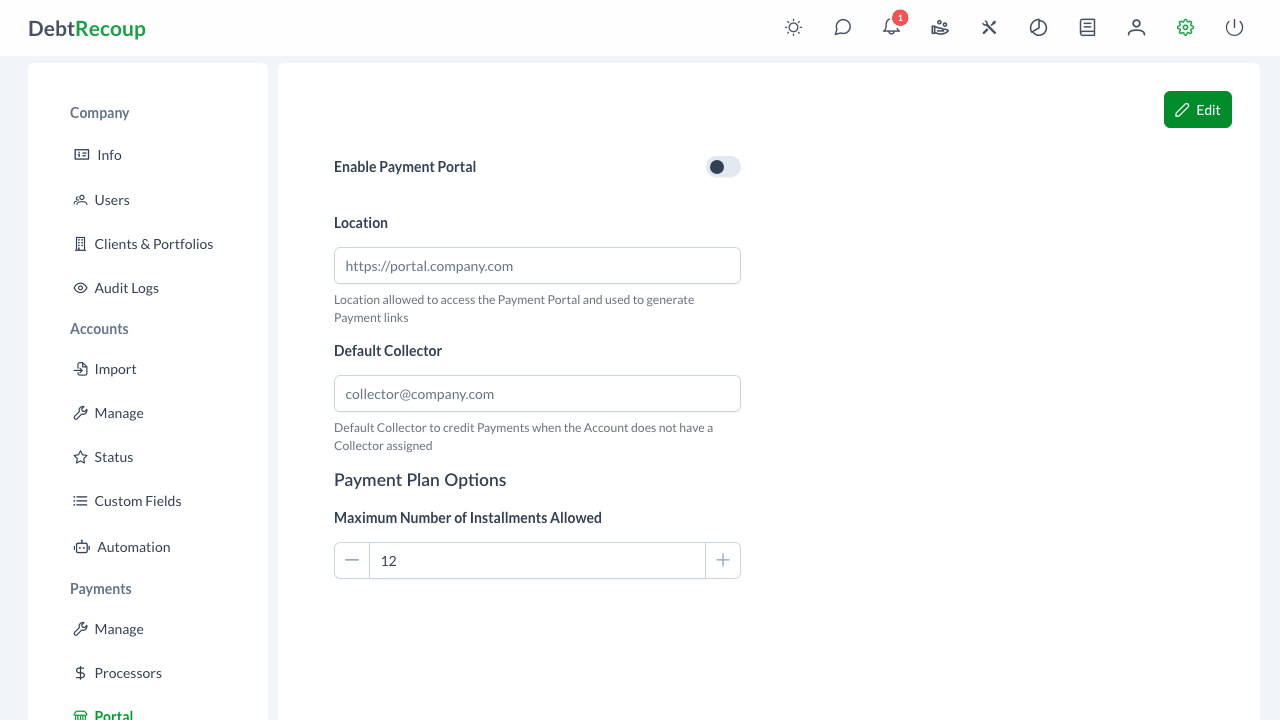

Enable Payment Portal

Toggle the portal on or off. When disabled, the embed code will not function and debtors cannot access the portal.

Location (URL)

The URL where your payment portal will be hosted. This should be a domain you control where you'll embed the portal code.

Example: https://payments.yourcompany.com

Embed Code

When the portal is enabled, an embed code is automatically generated. This JavaScript snippet loads the payment portal on your website.

Example embed code:

html

<div>

<script async src="https://app.debtrecoup.com/portal/payment.js"></script>

</div>1

2

3

2

3

To copy the code:

- Click on the code field

- The code is automatically copied to your clipboard

- A "Copied!" confirmation appears

Default Collector

Select a user to credit payments when the account doesn't have an assigned collector. This ensures all portal payments are properly attributed.

Maximum Number of Installments

Set the maximum number of installments debtors can choose when setting up a payment plan through the portal.

- Minimum: 2 installments

- Maximum: 24 installments

- Default: 12 installments

Use the + and - buttons to adjust the value.

Setting Up the Payment Portal

Step 1: Configure Settings

- Click Edit to enter edit mode

- Toggle Enable Payment Portal on

- Enter your Location URL

- Select a Default Collector

- Set the Maximum Number of Installments

- Click Save

Step 2: Add the Embed Code

- Copy the generated embed code

- Add it to a page on your website at the URL you specified

- Test the portal by visiting the page

Step 3: Configure Payment Processor

Ensure you have a Payment Processor configured to process portal payments.

How the Portal Works

For Debtors

- Access - Debtor visits the portal URL or clicks a payment link

- Verify - Debtor enters identifying information to locate their account

- Review - Account balance and details are displayed

- Pay - Debtor chooses to make a single payment or set up a plan

- Confirm - Payment is processed and confirmation is shown

For Your Team

- Recording - Payments are automatically recorded on the account

- Attribution - Payment is credited to the account's collector (or default collector)

- Tracking - Payment appears in reports and account history

Portal Features

Single Payments

Debtors can make one-time payments for any amount up to their full balance.

Payment Plans

Debtors can set up payment plans with:

- Configurable number of installments (up to your maximum)

- Automatic payment scheduling

- Clear breakdown of payment amounts

Multiple Accounts

If a debtor has multiple accounts, they can select which account to pay from a list.

Payment Methods

The portal supports payment methods based on your configured Payment Processor.

Security

Account Verification

Debtors must verify their identity before viewing account information. The verification process requires information only the debtor should know.

Secure Payments

All payment information is transmitted securely and processed through your configured payment processor. Payment card details are never stored in DebtRecoup.

URL Protection

Only requests from your configured Location URL are accepted.

Troubleshooting

Portal Not Loading

- Verify the portal is enabled in settings

- Check that the embed code is correctly placed on your page

- Ensure the Location URL matches where the code is embedded

- Check browser console for JavaScript errors

Payments Failing

- Verify your payment processor is configured and active

- Check that a default payment processor is set

- Test the payment processor directly to ensure it's working

Debtor Can't Find Account

- Verify the account exists in DebtRecoup

- Check that the debtor is entering correct identifying information

Related Topics

- Payment Processors - Configure payment processing

- Payment Processing - Manual payment entry